Sur l'agenda | Manifestations scientifiques

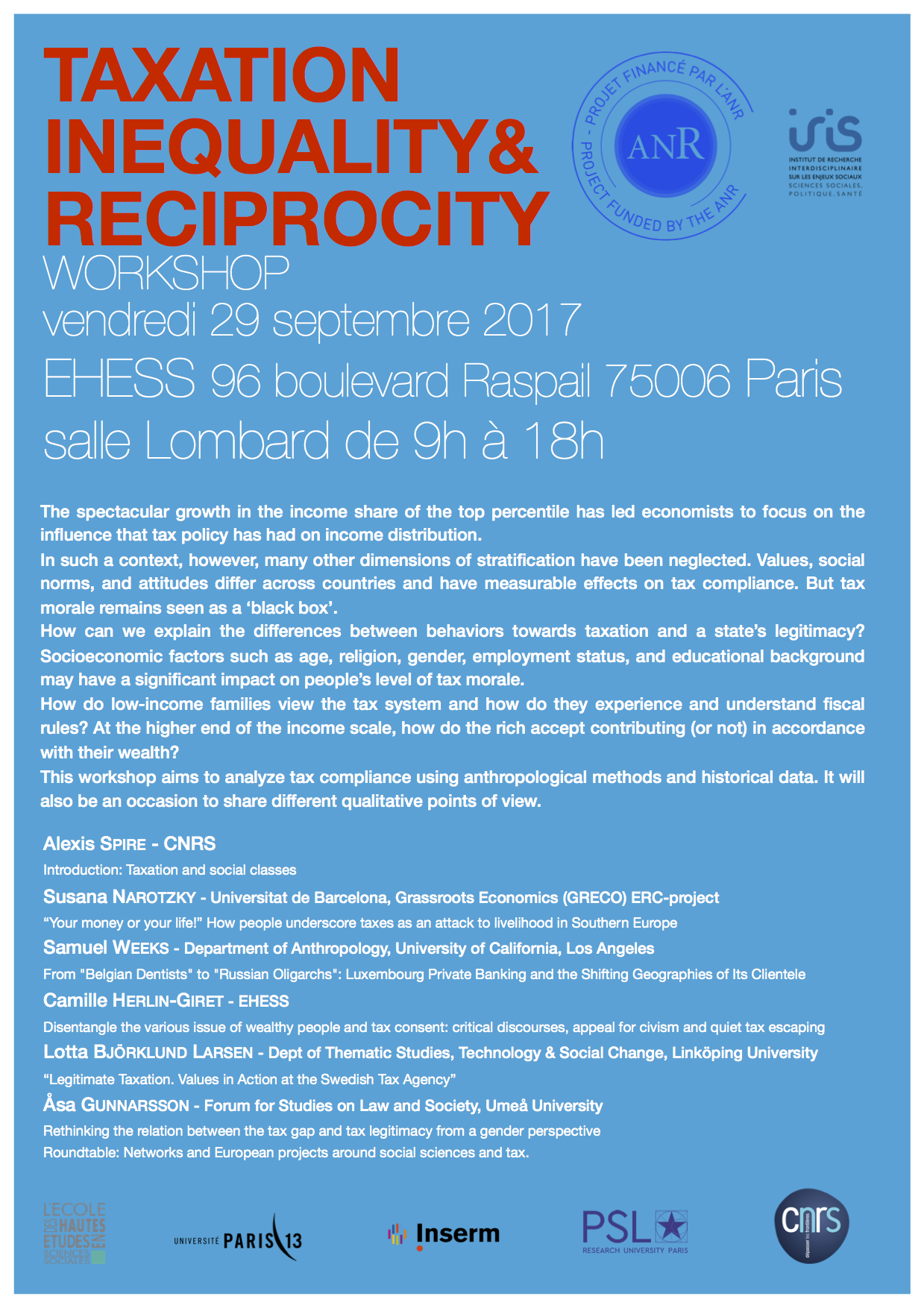

Workshop > Taxation, inequality and reciprocity - 29th September 2017

EHESS, 96 boulevard Raspail 75006 Paris, salle Lombard

Taxation, inequality and reciprocity

Workshop, Paris, 29th September 2017, 9h-18h

EHESS, 96 boulevard Raspail 75006 Paris, salle Lombard

The spectacular growth in the income share of the top percentile has led economists to focus on the influence that tax policy has had on income distribution. In such a context, however, many other dimensions of stratification have been neglected. Values, social norms, and attitudes differ across countries and have measurable effects on tax compliance. But tax morale remains seen as a ‘black box’. How can we explain the differences between behaviors towards taxation and a state’s legitimacy? Socioeconomic factors such as age, religion, gender, employment status, and educational background may have a significant impact on people’s level of tax morale. How do low-income families view the tax system and how do they experience and understand fiscal rules? At the higher end of the income scale, how do the rich accept contributing (or not) in accordance with their wealth?

This workshop aims to analyze tax compliance using anthropological methods and historical data. It will also be an occasion to share different qualitative points of view.

Program

9h00 : Welcome coffee

9h15

- Alexis Spire, Centre National de la Recherche Scientifique : Introduction: Taxation and social classes

10h00

- Susana Narotzky, Universitat de Barcelona, Grassroots Economics (GRECO) ERC-project : “Your money or your life!” How people underscore taxes as an attack to livelihood in Southern Europe

10h45: coffee break

11h00

- Samuel Weeks, Department of Anthropology, University of California, Los Angeles : From "Belgian Dentists" to "Russian Oligarchs": Luxembourg Private Banking and the Shifting Geographies of Its Clientele

11h45

- Camille Herlin-Giret, IRIS-EHESS : Disentangle the various issue of wealthy people and tax consent: critical discourses, appeal for civism and quiet tax escaping

12h30: Lunch

14h30

- Lotta Björklund Larsen, Department of Thematic Studies - Technology and Social Change, Linköping University : "Legitimate Taxation. Values in Action at the Swedish Tax Agency"

15h15

- Åsa Gunnarsson, Forum for Studies on Law and Society, Umeå University : Rethinking the relation between the tax gap and tax legitimacy from a gender perspective

16h00

- Roundtable: Networks and European projects around social sciences and tax

A consulter :

- Atelier "Sciences sociales et santé mentale" 2024-2025

- Workshop > Critical Ethnography Of Mining Encounters - 25-26 september 2024

- Colloque international > La quantification des inégalités de santé. Enjeux théoriques et méthodologiques - 4-5 juillet 2024

- Colloque > La Palestine et le monde - 13-14 juin 2024

- JE > Suds et santé, quelques enjeux - 14 juin 2024

- Les ateliers de recherche de la Plateforme Santé SHS > Inégalités de genre et santé - 3 juin 2024

- Colloque > Autour de Marc Bessin - 11-12 juin 2024

- Workshop > The Many Uses of DNA. Politics and Policies of Genetics - 28 mai 2024

- Symposium > Re-Imagining Punishment - 28 mai 2024

- Colloque international > La quantification des inégalités de santé. Enjeux théoriques et méthodologiques - 4-5 juillet 2024

- Doctoriales de l'Iris > Déviance │Environnement │Santé - 14 mai 2024

- Atelier Sciences sociales et Santé mentale > Que nous dit la psychopathologie de l'évolution des rapports de genre ? - 13 mai 2024

- Les ateliers de recherche de la Plateforme Santé SHS > Enquêtes sur le cancer - 6 mai 2024

- Atelier Sciences sociales et Santé mentale > Traumatisme - 25 mars 2024

- JE > Actualité des recherches sur les mineurs en prison – 21 mars 2024

- JE > L’industrie des pesticides sous le regard des sciences sociales. Produire, promettre, se défendre - 21-22 mars 2024

- Colloque > Par le droit, pour les droits : 50 ans de combats du GISTI - 15-16 mars 2024

- JE > Maïeutique & Violences - 11 et 12 mars 2024

- Les ateliers de recherche de la Plateforme Santé SHS > Santé et organisation du travail - 4 mars 2024

- JE > Santé et évolution de la Protection Sociale – 8 février 2024

- Les ateliers de recherche de la Plateforme Santé SHS > Enquêter sur la santé en Seine-Saint Denis – 5 février 2024

- JE > Visions chamaniques. Perceptions et expressions visionnaires en Amazonie et ailleurs – 23 janvier 2024

- JE > Les figures de l’adolescence aux Nords et aux Suds - 19 décembre 2023

- Atelier Sciences sociales et Santé mentale

- JE > Travail et santé - 7 décembre 2023

- Colloque > Les choses du cerveau : Histoire, usage, circulation des savoirs des sciences du cerveau – 6 et 7 décembre 2023

- Colloque > Autour de la santé au travail et de la loi du 2 août 2021 – 8 novembre 2023

- Workshop > Regards sociologiques sur le médicament : les régulations en question - 10 novembre 2023

- Colloque international > Violences sexuelles dans l'Église catholique. Perspectives comparatistes - 2 et 3 novembre 2023

- Colloque > Penser le travail au prisme des cancers professionnels – 16-17 octobre 2023

- Colloque > Les Indésirables au Camp de Gurs - 13 octobre 2023

- ½ journée d'étude > Santé sociale : une alternative au capitalisme sanitaire ? - 29 septembre 2023

- Conférence > Rewilding Food and the Self - 28 septembre 2023

- Colloque > Alternance politique, continuité administrative ? Contribution à une sociologie de l'inertie des politiques publiques - 18-19 septembre 2023

- Colloque international > Migrations, familles, droits. Comparaisons franco-allemandes - 6-7 septembre 2023

- JE > Promesses technoscientifiques en santé numérique – 23 juin

- JE > L’accès aux soins : enjeux autour de la production, de la fourniture et du financement du soin – 16 juin 2023

- JE > Éthique et Responsabilité de la recherche biographique - 5 juin 2023

- JE > Entre rapports de pouvoir et émancipations : repenser la complexité du monde culturel associatif – 1er juin 2023

- Colloque > Racial Borders - 31 mai 2023

- Sandwich Club de Lecture de l'Iris > 22 mai 2023

- Colloque international > Penser l'actualité politique - 11-12 mai 2023

- Doctoriales de l'Iris – 16 mai 2023

- Colloque > Robert Castel Actualité & réception internationale - 3-4 avril 2023

- Didier Fassin, Professeur du Collège de France : Sciences sociales par temps de crise - Leçon inaugurale - 30 mars 2023

- Charles Sabel, professeur invité de l'EHESS

- JE > Le travail reproductif dans tous ses états. Travail des droits, du politique, de la dette, du patrimoine, du temps et du religieux - 22 mars 2023

- JE > Entre rapports de pouvoir et émancipations : repenser la complexité du monde culturel associatif – 1er juin 2023

- Séminaire du groupe de travail "Santé numérique" 2022-2023

- Journée d’étude > Mal-être agricole : recherches en cours et nouveaux enjeux – 19 janvier 2023

- !!! REPORTÉ !!! Colloque international > Les violences sexuelles dans l'Église catholique

- JE > Naissances : de la procréation aux premiers mois de vie - 7 décembre 2022

- JE > Pratique de la recherche - Autour des travaux de Michel Bozon - 29 novembre 2022

- JE > Les routes du soi - 21 novembre 2022

- JE > "Terrains minés" Enjeux scientifiques et éthiques du travail ethnographique en contexte extractif - 29 novembre 2022

- JE > L'adultéité en question Normes, représentations, expériences - 25 novembre 2022

- Colloque interdisciplinaire et international > Entreprises sociales : quels statuts, quels acteurs, pour quel impact ? 9-10 novembre 2022

- Colloque > Risques, crises et sciences humaines et sociales : vers des observatoires inclusifs santé-environnement-travail - 24-26 octobre 2022

- Journée Ined Iris - 12 octobre 2022

- Rencontre autour de l’ouvrage Photo de famille. Penser des vies intellectuelles d’un point de vue féministe - 23 juin 2022

- Colloque > Cancers pédiatriques et génomique : un changement majeur ? - 23-24 juin 2022

- Axe 1 > Séminaire - lundi 20 juin 2022

- Journée d'étude > Tuberculose et Migration - 13 juin 2022

- Journées d'étude > Santé et sexualité : pratiques, techniques et savoirs - 20-21 juin 2022

- Actualité de la recherche sur les matériaux humains. Regards croisés droit-anthropologie - 24 mai 2022

- Projection et discussion > Les derniers condamnés pour homosexualité - 17 mai 2022

- Conférence de Miriam Ticktin > Le Care et Le Commun : Expérimentations en Alter-Politiques - 17 mai 2022

- Journée de l’École Doctorale de l’EHESS : L’éthique de la recherche en sciences sociales - 10 mai 2022

- Ecole thématique : Utopies/dystopies dans le champ de la santé : Anticipations, promesses et pratiques politiques

- Doctoriales de l'Iris - 10 mai 2022

- Atelier de recherche : La dimension sociale et culturelle des troubles psychiques : la variable de l’âge - 18 février 2022

- Les Doctoriales de l'Iris – 4 février 2022

- JE > L’œuvre et l'archive : dialogues autour du fonds Pierre Bourdieu – 3 février 2022

- JE > Les spiritualités dans le travail socio-éducatif - 27-28 janvier 2022

- Colloque > Éthique de la Recherche en Terrains Sensibles - 2-3 décembre 2021

- JE > Endométriose et inégalités. Expériences, expertises, problème public - 21-22 octobre 2021

- Journée de l’Ined et de l’Iris - 20 octobre 2021

- Table-ronde > La caméra, un outil pour les sciences sociales – 12 octobre 2021

- Colloque > Sexualité et classes sociales - 29-30 sept. et 1er octobre 2021

- Conference > S. Eben Kirksey : Impure Hopes: CRISPR and an HIV Cure - 15 septembre 2021

- Colloque > Comment entre-t-on en religion ? Vocations religieuses et sociétés européennes de la fin du XVIIIe siècle à nos jours - 17-18 juin 2021

- Atelier-débat > Recherches sur la persécution des personnes dites nomades en France de 1940 à 1946 - 28 mai 2021

- Colloque > Vies invisibles, morts indicibles - 17 juin 2021

- Colloque > "Développez-vous !" : pratiques et ambivalences du développement personnel – 17-18 juin 2021

- Colloque international > Genre et travail social – 10 et 11 juin 2021

- Colloque > Usagers et usagères : face à la dématérialisation des services publics - 31 mai - 1er juin 2021

- The Field of the ‘Photographable’: From the Global North to the Global South and from the Global South to the Global North - 17 et 18 mai

- 2es Journées d’étude SHS/Pesticides - 11-12 mai 2021

- Table-ronde > Discussion entre Annie Ernaux et Rose-Marie Lagrave : Expériences et écritures de transfuges de classe féministes - 26 mai 2021

- Colloque > Les rapports de pouvoir en littérature. Manifestations et mises en scène des formes de stigmatisation, de domination et de résistance dans l'espace littéraire - 6 et 7 mai 2021

- Journée d'étude > Travailler les âges en professionnel.le - 30 mars 2021

- Theatrum Mundi > Crafting a sonic urbanism: listening to non-human life – 18 mars 2021

- Journées d'étude > Faire face aux violences sexuelles. Résistances des acteur·rice·s, outils des chercheur·e·s - 11 et 12 mars 2021

- Rencontre-débat > "Se ressaisir", avec Rose-Marie Lagrave et Philippe Artières

- Atelier de Recherche et de Traduction en Sciences Sociales > visioconférence - 19 février 2021

- Colloque > Des mineurs comme les autres ? Approche pluridisciplinaire de la prise en charge des mineurs non accompagnés (MNA) – 29-30 janvier 2021

- Atelier > De Ricœur à Aristote. Traductions et génétique d’une pensée - 13 novembre 2020

- Atelier > Cuba au prisme des sciences sociales - 13 novembre 2020

- Symposium > Genre et alimentation à l’épreuve de la vie urbaine – 30 septembre & 1er octobre 2020

- Journée d'étude > Rencontres autour du jeu, 2e édition - 15 octobre 2020

- Les Journées de l'INED et de l'IRIS - 1 et 2 octobre 2020

- Journée > Estimation d’âge des adolescents migrants - 30 mars 2020

- Colloque > Images et imaginaires au Moyen-Orient et en Afrique du Nord – 2 mars 2020

- Colloque > Des féminismes noirs en contexte (post)impérial français ? Histoires, expériences et théories – 3-5 mars 2020

- Colloque > Images et imaginaires au Moyen-Orient et en Afrique du Nord - 23 janvier 2020

- Chaire de Santé publique du collège de France > leçon inaugurale de Didier Fassin - 16 janvier 2020

- Colloque > Face à l'État. Pratiques et représentations ordinaires face à l'État - 10 janvier 2020

- Doctoriales de l'Iris 2020 - 10 janvier

- Colloque > Crafting a Sonic Urbanism: the Political Voice - 13 décembre 2019

- Conférence internationale > Corporate Interests and Public Health. Knowledge, Expertise, Markets – 9-11 décembre 2019

- École thématique > Institutions de soin : crises et transformations aux Nords et aux Suds- 25-29 novembre 2019

- Colloque > Atteintes à l'environnement et santé : approches juridiques et enjeux transdisciplinaires - 21-22 novembre 2019

- International workshop > Future food: innovations, morals and politics - 15 november 2019

- Colloque > Du travail au lieu de vie. Quelles mobilisations contre les risques professionnels et les atteintes à l’environnement ? - 14-15 novembre 2019

- Colloque > Débordements industriels : face à une contamination par l'amiante, mobilisations citoyennes et (in)action publique - 12 novembre 2019

- Colloque > La ville et les sciences sociales. Ce que la ville fait à l'anthropologie, ce que l'anthropologie fait à la ville - 7-8 novembre 2019

- Colloque > Ignorance, pouvoir et santé - 21-22 octobre 2019

- Colloque > Rencontres autour du jeu - 10-12 octobre 2019

- Colloque > Santé /social aux frontières de l’intime : la place de l’intervention sociale - 26-27-28 juin 2019

- Journée d’étude > Anonymats urbains. Ethnographies comparées – 17-18 juin 2019

- Rencontre avec l’artiste Taysir Batniji - 24 mai 2019

- Journées d'étude > Bourdieu et les Amériques : Une internationale scientifique – 6-7 juin 2019

- Nicolas Jaoul invité de la MSHS-Toulouse > Projection-débat et Conférence – 3-4 juin 2019

- Colloque international > Stonewall 50 ans après. Héritages et constructions mémorielles des émeutes de 1969 – 3-5 juin 2019

- Interdisciplinary conference > Pesticide Politics in Africa - 28-31 may

- Journée d'étude interdisciplinaire > Dialogues autour de l’œuvre de Karl Jacoby – 21 mai 2019

- Journée d’étude > Conflits d’intérêts et médicament - 9 mai 2019

- Journée d'étude > Formation professionnelle des enseignants et numérique - 12 avril 2019

- Professeur invité EHESS > Carlos Mondragon, anthropologue (El Colegio de México)

- Journées d'étude > Death in time of crisis, funeral in crisis? / Moralités de crise, funérailles en crise ? - 25-26 mars 2019

- Journée d'étude > Underground ! Écrire l'histoire du punk et des cultures alternatives - 23 mars 2019

- Colloque > Sauvages ! Promesses et pratiques contemporaines de l’ensauvagement - 28 mars 2019

- Colloque > Instituer la famille. Gouvernement, subjectivité, engendrement - 21-22 février 2019

- Atelier > L’ethnographe dans un centre pour réfugiés – 13 février 2019

- Journée d’étude > Police, justice et homosexualités. Regards historiques, sociologiques et comparatifs - 15 février 2019

- Journée d'étude > Penser la révolution iranienne au temps présent - 11 février 2019

- Journée d'étude > Santé mentale et souffrance psychique : un objet pour les sciences sociales - 12 décembre 2018

- Conference > Queer Studies: Here, There and Elsewhere – 7-8 december 2018

- Colloque international > Saisir le transnational dans les mondes arabes contemporains. Objets, méthodes et terrains - 3-4 décembre 2018

- Workshop > Des influences toxiques ? Industrie chimique et santé publique - 29 novembre 2018

- Cycle "Bienfaisance et gouvernement du social" - 29 novembre 2018

- Journée d'étude > De l’usage de la biographie en situation coloniale - 5 octobre 2018

- Colloque international > Identité et identification par l’ADN : enjeux sociaux des usages non médicaux des analyses génétiques – 11-12 octobre 2018

- Colloque international > L’émigration-immigration comme "fait social total" - 26-28 septembre 2018

- Symposium > Forensic Anthropology Society of Europe - 22 septembre 2018

- Workshop > Le cadavre et ses avatars - 6-7 septembre 2018

- Atelier > Quel(s) sol(s) pour nourrir les villes de demain ? - 11 juillet 2018

- Global Conference > Genocide and Mass Violence : diagnosis, treatment, and recovery ? Humanities, social and medical sciences facing extreme violence, 4-7 july 2018

- Colloque > Les destinataires du travail social : résistances, adhésions et tactiques face aux normes de genre - 02-03 juillet 2018

- Journée d'étude > Le sang : siège de l’âme. Approches religieuses – 22 juin 2018

- Journée d’étude > Underground. Ecrire l’histoire du punk et de cultures alternatives – 23 juin 2018

- Demi-journée d'étude > Réserves minières, réserves de change des pays de la zone franc - 12 juin 2018

- Colloque international autour des travaux de Gérard Noiriel > Héritages et actualités de la socio-histoire - 14-15 juin 2018

- Table-ronde > Care, genre et politiques sociales : des enjeux très politiques - 19 juin 2018

- Matinée de débat > Intérêts agro-industriels et santé publique – 17 mai 2018

- Colloque > Sortir du colonial. Transformations institutionnelles et rapport à l'État (école et justice) - 9-10 avril 2018

- Symposium > Arts de l'image, automédialité et fabrique de soi - 6 avril 2018

- Journée d'étude > Les institutions pénales saisies par les gouverné.e.s - 3 avril 2018

- Colloque > Drogues et Politiques dans les Amériques - 11-13 avril 2018

- Journée d'étude > Politiques de la marge. Productions et usages - 29 mars

- Conférence publique > Fichiers & témoins génétiques : généalogies, enjeux sociaux, circulation - 28 mars 2018

- Journée d'étude > L’optimisation au/du quotidien. De l’injonction à l’appropriation - 22 mars

- Journées d’étude > "Rencontres entre écritures ethnographiques et formes artistiques. Les mises en scène du divers" 7-8 mars

- Conférence > Didier Fassin : "Le désir de punir. Une anthropologie du châtiment" - 2 mars

- Colloque > La Constitution face au changement climatique - 8 mars 2018

- Journée d'étude > Des cadavres dans nos poubelles - 8-9 février 2018

- Journée d’étude > Vieillesses (im)mobiles. Analyses pluridisciplinaires des mobilités locales au grand âge – 5 février 2018

- Journées d’étude > Santé mentale en prison : État des savoirs, besoins, perspectives - 21-22 décembre 2017

- Colloque international > Genre et Contraception : quelles (r)évolutions ? – 18-19 décembre 2017

- Conférence > Mara Viveros : "Les couleurs de la masculinité" - 11 décembre 2017

- Journée d'étude > Enquêter sur la bienfaisance. Approches comparatives des pratiques du bien - 11-12 décembre 2017

- Journée d'étude > Matérialismes féministes, faire & défaire les controverses – 8 décembre 2017

- École thématique interdisciplinaire de recherche > La mondialisation de la santé : savoirs, pratiques, politiques - 23-27 octobre 2017

- Colloque international > Le droit au service de la justice climatique : Jurisprudences et mobilisations citoyennes – 3 novembre 2017

- Rencontre-débat > Afrique et Moyen-Orient : les élites et l'ancien bloc socialiste - 17 octobre 2017

- Journée d'étude > Les représentations du sang dans les sciences médicales et dans la pratique médicale et chirurgicale (France, Italie, Espagne, XVe-XVIIIe s.) – 13 octobre 2017

- Savante banlieue > Deux "Grandes conférences", par Bertrand Pulman et par Elisabeth Belmas - 12-13 octobre

- Séminaire > Retours d’expériences, les tribunaux environnementaux d’opinion : du politique au droit - 10 octobre

- Colloque international > Le bien-être dans l’éducation : un objet de recherche pour les sciences humaines et sociales - 2-4 octobre

- Workshop > Taxation, inequality and reciprocity - 29th September 2017

- Journée d'étude > Handiparentalités et présences animales : Quelles circulations du care entre parents, enfants et chiens-guides ? - jeudi 28 septembre 2017

- Search and Identification of Corpses and Human Remains in Post-Genocide and Mass Violence Contexts > 9-11 septembre 2013

- Development Policies, Space And Violence In Latin America: An Interdisciplinary Discussion - 20 th July

- ANR MEDICI > Conférence publique de Denis Bourguet et Thomas Guillemaud (INRA) : "Les conflits d'intérêts dans la recherche sur les OGM" - 26 juin 2017

- Colloque > Le retour des classes sociales dans les mondes post-socialistes ? Conditions et modalités d'un renouveau des grilles de lecture du monde social post-socialiste - 13 juin 2017

- Journée d’étude > "Passer pour" : Approches empiriques des "passings" (race, genre, classe, âge, religion) – 27 juin 2017

- Séminaire "Justice climatique, contentieux nationaux et société civile" – 8 juin 2017

- Journée d'étude > Big data & SHS. Regards et intérêts croisés pour la santé publique - 16 juin 2017

- Table-ronde Tepsis > Sous l’emprise de la folie ? Des pratiques psychiatriques à la responsabilité humaine – 16 mai 2017

- Colloque international > Briser l'invisibilité des cancers d'origine professionnelle Mise en perspective internationale de l'expérience du Giscop 93 - 1er juin

- Rencontre avec John Gibler > Récit et témoignages de la violence au Mexique

- Atelier > Traduire les sciences sociales : éléments pour une critique génétique - 11 avril 2017

- Séminaire "La mobilisation du droit par les associations en matière environnementale" - 27 avril 2017

- Demi-journée d'étude > Usages traditionnels et modernes des psychotropes - 27 avril 2017

- Colloque du réseau Droit & Climat > Quel(s) droit(s) pour les changements climatiques ? - 31 mars 2017

- Journée d'étude > Vieillissement et mobilités géographiques : famille, care et migrations - 1er mars 2017

- Colloque du réseau Droit & Climat > Quel(s) droit(s) pour les changements climatiques ? - 31 mars 2017

- Séminaire de recherche : A la recherche de la justice environnementale et climatique - 8 février 2017

- Sangres políticas: Ciudadanías y biométrica en Europa y América Latina / Sangs politiques : Citoyennetés et biométrique en Europe et en Amérique Latine – 8-9 décembre 2016

- Journée d’étude pluridisciplinaire > Génétique humaine : questions posées par l’information à la parentèle et par les nouvelles technologies de séquençage – 16 décembre 2016

- Colloque international Altexpert > "Mieux équiper la décision en santé au travail : De quelle(s) science(s) a-t-on besoin ?" - 6-7 décembre 2016

- Table ronde > "N(o)stalgies africaines " - jeudi 24 novembre 2016

- Conférence Eugène Fleischmann > Didier Fassin : "Asile : la fin d'une illusion ?" - 25 novembre 2016

- COP22 > Evénements officiels organisés par la Structure fédérative Développement durable - Université Paris 13 et le CIDCE

- Paroles, langues et silences : le cinéma comme on l'entend

- Séminaire "Sciences sociales et prisons" > "Populisme pénal : la prison saisie par le politique" - 14 novembre 2016

- Journée de professionnalisation "La thèse, et après ? Transmettre et enseigner" - 14 novembre 2016

- Rencontre-débat > Exil et expulsions - 19 octobre 2016

- Table-ronde > Anciennes étudiantes du continent africain formées dans les pays de l'Est - 11 octobre 2016

- Colloque international > Gouverner les pratiques économiques - 26-27 septembre 2016

- Le Déjeuner sous l'herbe > "Journée fouilles ouvertes" - mardi 27 septembre 2016

- Seminario > Ciudad y Dictadura. Proyectos urbanos de la dictadura militar en Argentina (1976-1983)

- Débat > Femmes dirigeantes : la fabrication des exceptions – jeudi 6 octobre

- Projection-débat > Les Sentinelles, de Pierre Pézerat - vendredi 16 septembre

- Assises > Technique, médecine et santé. Les envers d'un mythe du progrès

- Rencontres du Lab School Network, en partenariat avec le Carrefour numérique 2 de la Cité des sciences

- Journée d’étude > Fichiers et témoins génétiques. Au carrefour de la science, de la sécurité et des libertés - 01 juillet 2016

- Journée d'étude > Cultures à la barre : regards croisés sur la justice outre-mer - 23 juin 2016

- Journée d'étude > International Study Day «Colonialism and Disability»

- 3 conférences de Bastien Bosa, invité à l'EHESS > 26 mai, 31 mai et 9 juin 2016

- Journée d'étude > Pratiques sexuelles et pratiques sexuées à l’âge séculier – 23 mai 2016

- Colloque > Mondialisation & droit du développement durable sous l’angle cinématographique - 14 juin 2016

- Colloque > L'intervention sociale au prisme du genre – 19-20 mai 2016

- Journées d'étude > Tricontinentales

- Exposition et Journée d'étude > Les travailleurs indochinois en région toulousaine pendant les deux guerres mondiales – 1er avril 2016

- Didier Fassin > Tanner Lectures

- Journée d'étude > La notion de compétence dans les formations sociales unversitaires

- Journée d'étude > L'urbanisation comme instrument de guerre. La construction des villages stratégiques au sein des politiques de contre-insurrection

- Cycle "Images et terrains" > Paroles, langues, silences : le cinéma comme on l'entend

- Journée d’étude > Environnement-Développement et Droits de l'homme. Responsabilité des acteurs privés - 17 mars 2016

- Non-Lieux de l'Exil > La langue matérielle de l’exil - 3 mars 2016

- Colloque & Workshop > Les SHS face au foisonnement biographique, 9-11 mars 2016

- Colloque > Politiser, dépolitiser, repolitiser - 25-26 février 2016

- Journée d'étude > Accès aux soins des populations démunies, France / Allemagne, 22 janvier 2016

- Table-ronde > Etudier à l'Est. Expériences de diplômés africains, 19 janvier 2016

- Journée d'étude > Médicalisations

- Rencontre mondiale des juristes de droit de l'environnement dans le cadre de la COP21

- Journée d'étude > Regards sur le médecin légiste

- Conférence internationale > South & East Mediterranean Youth Policies on a Tightrope

- Atelier Images et terrains sur "Le beau comme instantané, comme construction, comme partage"

- Journées d'études > Hommage à Fanny Colonna : Lectures et pratiques des "Versets de l'Invincibilité"

- 1/2 journée d'études > L'hypnose : quelles représentations sociales? 16 octobre 2015

- 3 conférences de Bastien Bosa, invité à l'EHESS / Iris > 28 mai, 4 juin, 5 juin 2015

- Projection-débat : La Traversée d'Elisabeth Leuvrey > 26 mai 2015

- Journées d'étude : Quand Robert Castel nous aide à penser le travail social et l’intervention sociale. La vulnérabilité dans tous ses états > 21-22 mai 2015

- Colloque international > Les sciences sociales face au changement à Cuba, 11 & 12 juin 2015

- Colloque Sécurité et Environnement > 8 juin 2015

- Journée d'étude > La morale des restes. Jeux de pouvoirs dans nos poubelles - 4 juin 2015

- Journées d’étude : Du trouble à la vigilance ethnographique > 20-21 mai 2015

- Journée d'études > Les violences invisibles - 19 mai 2015

- Journée d'études > Culture gaie, sexualité gaie - 16 mai 2015

- Seminar > Oikos: Affects, Economies and Politics of House-ing > May 14-16, 2015

- Des femmes respectables > conférence de Beverley Skeggs, 26 mars 2015

- Journées d'études > Etre jeune chercheur ou chercheure aujourd'hui : quelles réalités ? 10 et 11 mars 2015

- "Domestique" : une condition plurielle ? Les relations de travail des employé.e.s à domicile > 16 décembre 2014

- Le viol conjugal. Médecine et sciences sociales face à la violence sexuelle conjugale > 12 décembre 2014

- Étudiants africains en URSS et dans les autres pays du monde communiste. 1960-1990 > 20-21 novembre 2014

- La famille face à l'expérience cancer > 27 novembre 2014

- Premières rencontres annuelles d'ethnographie de l'EHESS > 5-7 novembre 2014

- Critical Approaches to the Ethnography of Violence > 27 octobre 2014

- Au cœur du vieillissement ? Regards croisés sur le corps > 12-13 novembre 2014

- Le métier de doctorant-e en SHS > 25 septembre 2014

- Truth Telling and Truth Seeking in Contexts of Impunity > 24 octobre 2014

- Étudiants africains en URSS et dans les autres pays du monde communiste. 1960-1990 > 20-21 novembre 2014

- (Dé)montrer le génocide. La patrimonialisation des restes humains au Rwanda (1994-2014) > 02 octobre 2014

- Du "bon enfant" à "l'enfant modèle" > 30 septembre 2014

- Corpses in Society. Human Remains in post-Genocide and Mass Violence Contexts

- Images et terrains : la note d'intention > 25-26 juin 2014

- La production des subjectivités dans le domaine du cancer > 5-6 juin 2014

- Journée d'études Santé - Précarité > 5 juin 2014

- Pouvoirs locaux et richesses des territoires > 2 juin 2014

- Après la violence / Despues de la violencia > 8-9 mai 2014

- Normes et régulations dans l’exercice de la contrainte > 27 mai 2014

- Séminaire de recherche ANR CIRCULEX > 20 mars 2014

- Journée d'études du groupe Traitements & Contraintes > 26 mars 2014

- Genre et violences de masse. La question du féminicide > 13 février 2014

- Le travail socio-éducatif au prisme du genre > 12-13 décembre 2013

- Pauvreté, économie informelle, économie populaire : que disent les mots? > 4 décembre 2013

- Agir pour chercher, chercher pour agir : recherches interventionnelles en SHS sur le cancer > 9 décembre 2013

- Les notions de la société civile. Usages et traductions > 29 novembre 2013

- Questions de théories : quels usages des classiques dans les études sur la contrainte ? > 14 novembre 2013

- Images et terrains. Cadrages photos et terrains > 12 novembre 2013

- George Chauncey : History, Politics and the Supreme Court in the US Debate over Same-sex Marriage > 25 octobre 2013

- Violence politique et mémoires sociales > 24 octobre 2013